From a V-Shaped Recovery to a 'Pear-Shaped' One?

Michael Panzner

pear shaped

A British expression used to indicate that something has gone horribly

wrong with a person's plans, most commonly in the phrase "It's all gone

pear shaped." The origin is unclear, but one theory says that it is RAF

slang relating to the difficulty of performing aerobatic loops, which were

described as "pear shaped" if executed imperfectly. (Source: Urban Dictionary)

Call me a cynic, but today's news from the nation's leading

small business association, detailed by Bloomberg in "Small-Business Confidence in

U.S. Falls to Eight-Month Low," doesn't exactly confirm the

view expressed by the head of the National Bureau of Economic Research's

Business Cycle Dating Committee that the recession is "clearly

over."

Confidence among U.S. small businesses fell in March to

the lowest level since July 2009 as executives grew more concerned about

earnings and sales, a private survey found.

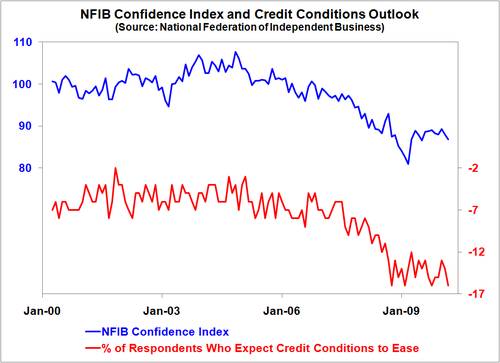

The National Federation of Independent Business’s optimism

index dropped to 86.8 last month from 88 in February, the Washington-based

group said today. Seven of the index’s 10 components declined last month and

two were unchanged from February. (Click to enlarge)

“Usually we see the small businesses leading the way out

since they’re the first ones to see the consumer come back, but what’s happened

this time is the consumer didn’t come back,” William Dunkelberg, the group’s

chief economist, said today in a Bloomberg Radio interview. While purchases

have increased, “there’s not enough sales to go around to make the whole

population of small businesses very healthy,” he said.

A gauge of expectations for business conditions six months

from now was the sole component that improved from the prior month, rising one

point. The report also showed that while workforce reductions may be over,

small businesses weren’t ready to add workers or spend more on new equipment.

The measure of earnings expectations showed the biggest

decline in March, falling 4 points to minus 43%. Thirty- four percent of

respondents cited “poor sales” as the top business concern, the same as in

February, and the net percent of owners projecting higher sales, adjusting for

inflation, fell to minus 3%.

Moreover, despite all the taxpayer-financed bailouts and other

assistance the banking industry has received, credit availabilty remains a

serious concern for small businesses, as the following chart illustrates.

Given how important small businesses are to the U.S. economy, it

looks like the alleged V-shaped recovery has gone

pear-shaped.