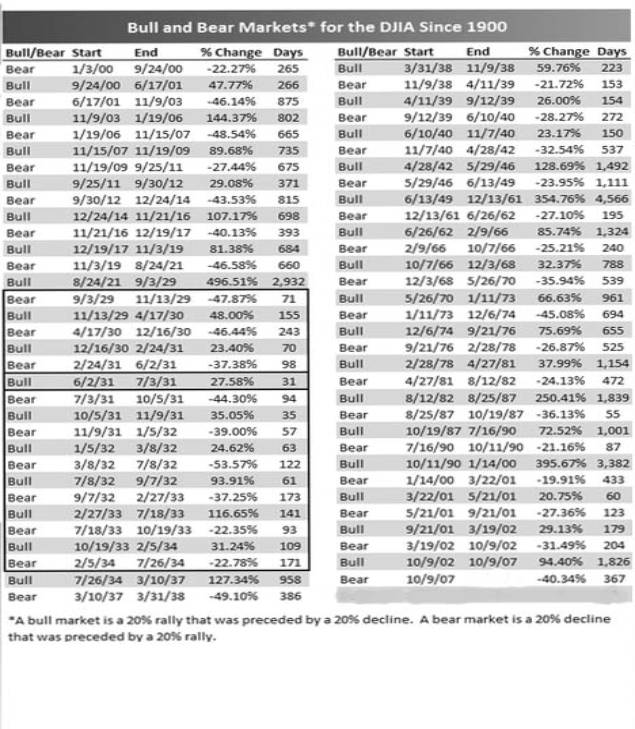

Historical Bull and Bear Markets for the Dow: 1900-Present

October 14, 2008 | about stocks: DIA

About the author:

In the past, we have just

focused on bull and bear markets for the Dow since World War II because the US

was still essentially an emerging market prior to then. However, since

the current market is unlike anything seen since the early 1900s, we've taken

the date range back further.

Since the end of World War

II, there have only been 13 bear markets and 12 bull markets using the standard

20% rally and decline measure. The average bull or bear since then has

lasted 911 calendar days. From 1900 to 1946, there were 20 bulls and 20

bears. From 1929 to 1934 alone, there were 9 bears and 8 bulls, and the

average bull or bear lasted just 105 calendar days.

Since volatility is currently at levels not seen since the 1930s, are we in store for a market where 20% rallies and declines become commonplace again? It's definitely a possibility. …... To hit the 20% gain threshold, the Dow needs to get back to 10,141.43, which is still a long ways away from the Dow's current level of 9,300.